All Categories

Featured

Table of Contents

- – Dependable Venture Capital For Accredited Inve...

- – Exclusive Top Investment Platforms For Accredi...

- – Cost-Effective Accredited Investor Property I...

- – Optimized Accredited Investor High Return Inv...

- – First-Class Accredited Investor Passive Inco...

- – Superior Accredited Investor Property Invest...

- – Expert Accredited Investor Investment Networ...

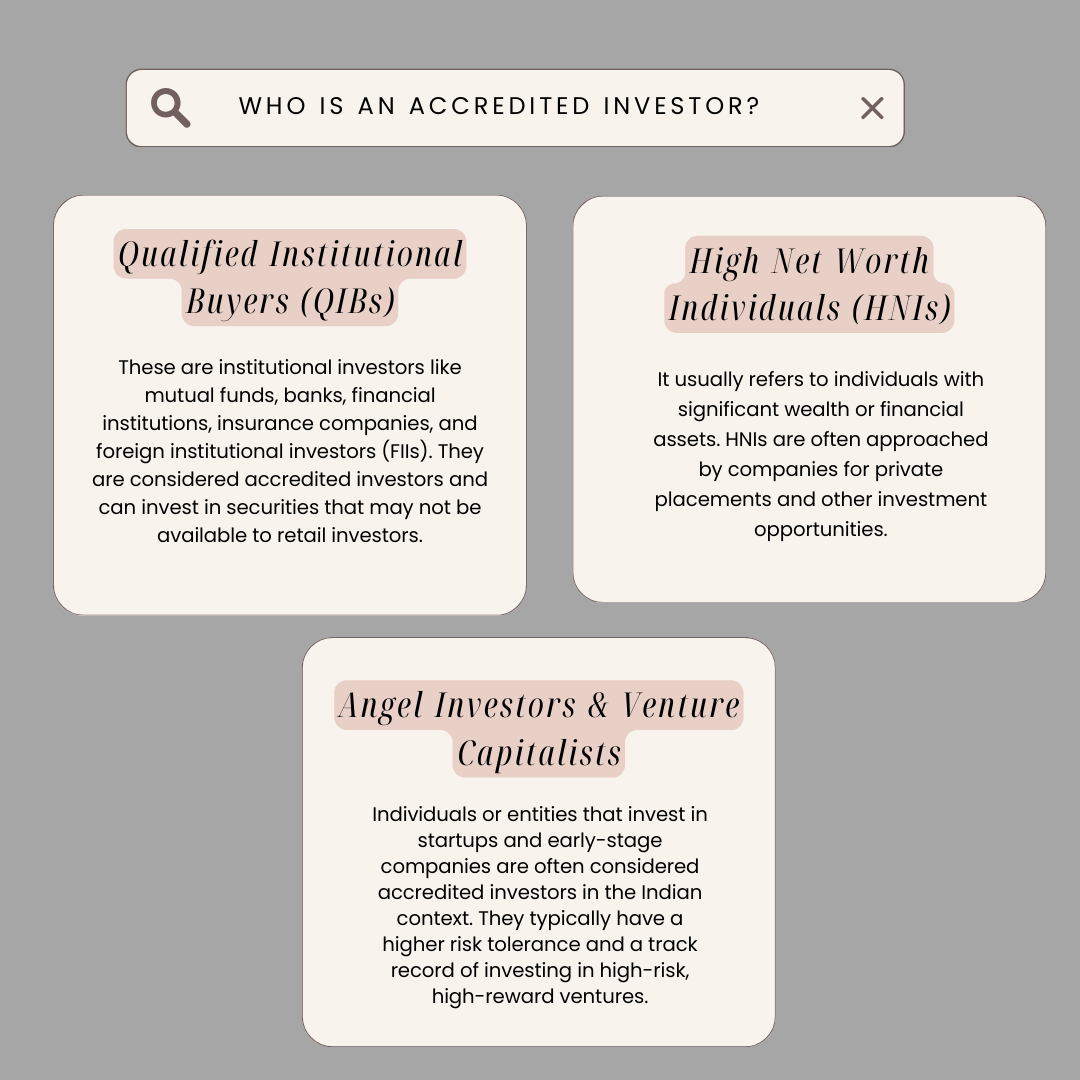

The guidelines for certified financiers vary amongst territories. In the U.S, the definition of an approved capitalist is presented by the SEC in Guideline 501 of Regulation D. To be an accredited financier, a person must have a yearly income going beyond $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of making the very same or a greater earnings in the existing year.

A certified investor ought to have a total assets going beyond $1 million, either separately or jointly with a partner. This amount can not include a key home. The SEC also thinks about applicants to be accredited investors if they are basic companions, executive officers, or directors of a business that is providing non listed safety and securities.

Dependable Venture Capital For Accredited Investors

If an entity consists of equity owners that are recognized capitalists, the entity itself is an accredited capitalist. A company can not be developed with the sole purpose of purchasing specific protections. An individual can qualify as a recognized capitalist by showing enough education or work experience in the financial industry

People who desire to be accredited capitalists do not relate to the SEC for the designation. Rather, it is the obligation of the company supplying an exclusive positioning to see to it that every one of those come close to are recognized capitalists. Individuals or events that wish to be certified investors can approach the issuer of the unregistered securities.

Mean there is an individual whose income was $150,000 for the last three years. They reported a key residence worth of $1 million (with a home loan of $200,000), a vehicle worth $100,000 (with a superior finance of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This individual's web well worth is exactly $1 million. Because they fulfill the internet worth demand, they certify to be a recognized capitalist.

Exclusive Top Investment Platforms For Accredited Investors

There are a couple of much less usual credentials, such as handling a count on with greater than $5 million in possessions. Under government safety and securities laws, just those that are certified financiers might participate in particular safeties offerings. These might include shares in private placements, structured items, and personal equity or hedge funds, to name a few.

The regulators intend to be certain that individuals in these extremely high-risk and complex investments can look after themselves and judge the threats in the absence of federal government security. The accredited investor guidelines are created to shield potential capitalists with limited monetary understanding from dangerous endeavors and losses they might be sick furnished to hold up against.

Recognized capitalists satisfy credentials and professional standards to access special investment possibilities. Designated by the United State Stocks and Exchange Compensation (SEC), they obtain entrance to high-return options such as hedge funds, financial backing, and private equity. These investments bypass complete SEC enrollment however bring higher dangers. Recognized investors need to fulfill income and total assets needs, unlike non-accredited people, and can invest without constraints.

Cost-Effective Accredited Investor Property Investment Deals

Some essential modifications made in 2020 by the SEC consist of:. Including the Collection 7 Series 65, and Collection 82 licenses or other qualifications that show monetary knowledge. This adjustment recognizes that these entity types are typically made use of for making investments. This change recognizes the experience that these staff members create.

These amendments increase the recognized investor swimming pool by approximately 64 million Americans. This wider gain access to supplies a lot more chances for capitalists, however also raises possible risks as much less monetarily advanced, capitalists can get involved.

These investment choices are special to accredited capitalists and institutions that certify as an approved, per SEC regulations. This gives recognized financiers the opportunity to spend in emerging business at a phase prior to they think about going public.

Optimized Accredited Investor High Return Investments for Accredited Investment Results

They are deemed investments and are obtainable just, to qualified customers. In addition to well-known companies, qualified investors can choose to purchase startups and promising endeavors. This offers them income tax return and the chance to enter at an earlier phase and possibly reap benefits if the firm thrives.

Nonetheless, for investors open up to the dangers entailed, backing start-ups can cause gains. Many of today's technology business such as Facebook, Uber and Airbnb stemmed as early-stage start-ups supported by accredited angel capitalists. Advanced financiers have the chance to explore financial investment choices that may yield much more profits than what public markets provide

First-Class Accredited Investor Passive Income Programs

Although returns are not assured, diversification and profile improvement alternatives are expanded for capitalists. By expanding their profiles with these increased investment avenues certified capitalists can enhance their methods and possibly accomplish premium lasting returns with correct risk management. Seasoned capitalists typically experience investment options that may not be quickly readily available to the basic financier.

Financial investment options and securities provided to approved investors normally include greater dangers. Exclusive equity, endeavor capital and bush funds commonly focus on spending in possessions that lug threat however can be sold off quickly for the possibility of greater returns on those high-risk investments. Looking into before investing is essential these in scenarios.

Lock up durations protect against financiers from taking out funds for even more months and years on end. Financiers may struggle to accurately value private properties.

Superior Accredited Investor Property Investment Deals

This change may prolong recognized investor condition to a range of individuals. Allowing companions in fully commited relationships to combine their resources for common eligibility as recognized financiers.

Enabling people with particular professional accreditations, such as Collection 7 or CFA, to qualify as recognized financiers. Producing added needs such as evidence of monetary proficiency or successfully completing an approved investor exam.

On the other hand, it might likewise result in knowledgeable financiers assuming too much risks that might not be suitable for them. Existing accredited capitalists might deal with increased competitors for the ideal financial investment chances if the swimming pool expands.

Expert Accredited Investor Investment Networks with Accredited Investor Support

Those who are presently thought about certified investors must remain upgraded on any type of alterations to the standards and regulations. Services looking for accredited capitalists ought to stay watchful about these updates to guarantee they are drawing in the best audience of financiers.

Table of Contents

- – Dependable Venture Capital For Accredited Inve...

- – Exclusive Top Investment Platforms For Accredi...

- – Cost-Effective Accredited Investor Property I...

- – Optimized Accredited Investor High Return Inv...

- – First-Class Accredited Investor Passive Inco...

- – Superior Accredited Investor Property Invest...

- – Expert Accredited Investor Investment Networ...

Latest Posts

State Property Tax Sales

How Do Tax Foreclosures Work

Government Property Tax Sale

More

Latest Posts

State Property Tax Sales

How Do Tax Foreclosures Work

Government Property Tax Sale